Creating a Budget for Investment Planning

Budgets help to lessen the danger of being short on cash due to any expenses we know about in advance. It can help to show how much we can afford to invest.

Creating a budget will help you organise your finances in several ways. It will highlight expenses that dominate your monthly spending, show you periods during the year where funds will be tight, allowing you to prepare, and it will make it clear how much you can safely invest on an ongoing basis.

The big question this post wants to uncover is how much should you invest each payday. This is impossible to answer until you create a budget. A budget will help you predict what your income and expenses are going to be on a month by month basis. Usually created for a full year, it allows you to plan for both regular and once off expenses.

Don’t be too worried about being totally accurate when creating your first budget; it is meant to give an indication of where shortfalls might show up and allow you to prepare in advance for them. The future is impossible to predict, so there will be unforeseen expenses you will have to deal with, but the power of a budget is that we don’t let the things we do know about cause financial pain.

So how do you start? Maybe the easiest way is to look backwards. Look at the your bank account for any regular bills such as telephone and other utilities. These are the easiest to predict although for electricity and other utilities, you might have fluctuating bills based on the seasons and prices that are charged.

Next try to track how much you spend on groceries. A good way to do this is to keep receipts for a month or two and see how much spending falls into this category. In fact it might be a good idea to keep all receipts for a while to help see where you are spending your money. Categorise the expenses into broad groups to make the budget easier to manage.

A budget also shows income. If you have a variable income then give your best effort to estimate future earnings. Do you earn while on vacation? If not, you must plan for these gaps by stating this on the budget plan.

Finally, try to identify less frequent income or expenses. These are things that might only crop up once per year and not show up with a small sample of expense analysis. Birthdays often require gifts or socialising expenses and Christmas and other holidays will also require more money than usual. Annual insurance premiums and tax should be entered on the budget also. Do you receive an annual bonus from your employer? Is it guaranteed?

Are you planning large once-off expenses, such as a car, furniture or taking on a mortgage, this year? It can be difficult to get the timing of the expense right, or the amount it will cost you either as a single expense or ongoing repayment, but do your best to make an estimate.

What you end up with is a total income and expense for each month. Do a quick calculation by subtracting expenses from income for each month on your budget. If the amount of expenses is greater than income, this shows a shortfall for the month. Don’t panic, we can prepare in advance for these months.

If the budget shows that you have a surplus in a month, you can carry this over into the next month. Often a budget will show several months of surplus amounts before an irregular expense brings it close to zero. A new calculation can track this surplus from month to month. Take the surplus from the first month and add (if it is another surplus) or subtract (if expenses are greater that month) the amount from the following month. Repeat this for each month of the year.

The purpose of the budget is to spot and plan for months where the carryover amount is negative. If your budget shows shortfalls in the first few months, then you will either need to draw from savings or reduce expenses. I suggest the latter.

The ideal is that there is a growing surplus amount showing up every month, with occasional dips as periodic expenses come up. This growing amount is what you are looking for. It can help you figure out how much you can afford to invest each month. Assuming that you have reduced expenses enough to get an overall surplus, how much is the. cumulative surplus after the last month? We can use this to try out how much to save. Divide the amount by twelve to get the amount to save or invest monthly.

Next go back to the budget and add this investment amount as an expense for each month. That’s right, treat it as if it is an expense. You cannot use its value to cover expenses in later months. Once invested it can no longer be used to pay for expenses. This is not altogether true; you could cash it in, but try to think of it as not available.

Recalculate all the totals and surplus amounts. Check for any negative amounts that this new expense causes. You might need to adjust the amount several times until you get it right; the idea is that there should be no negative amounts caused by the investment.

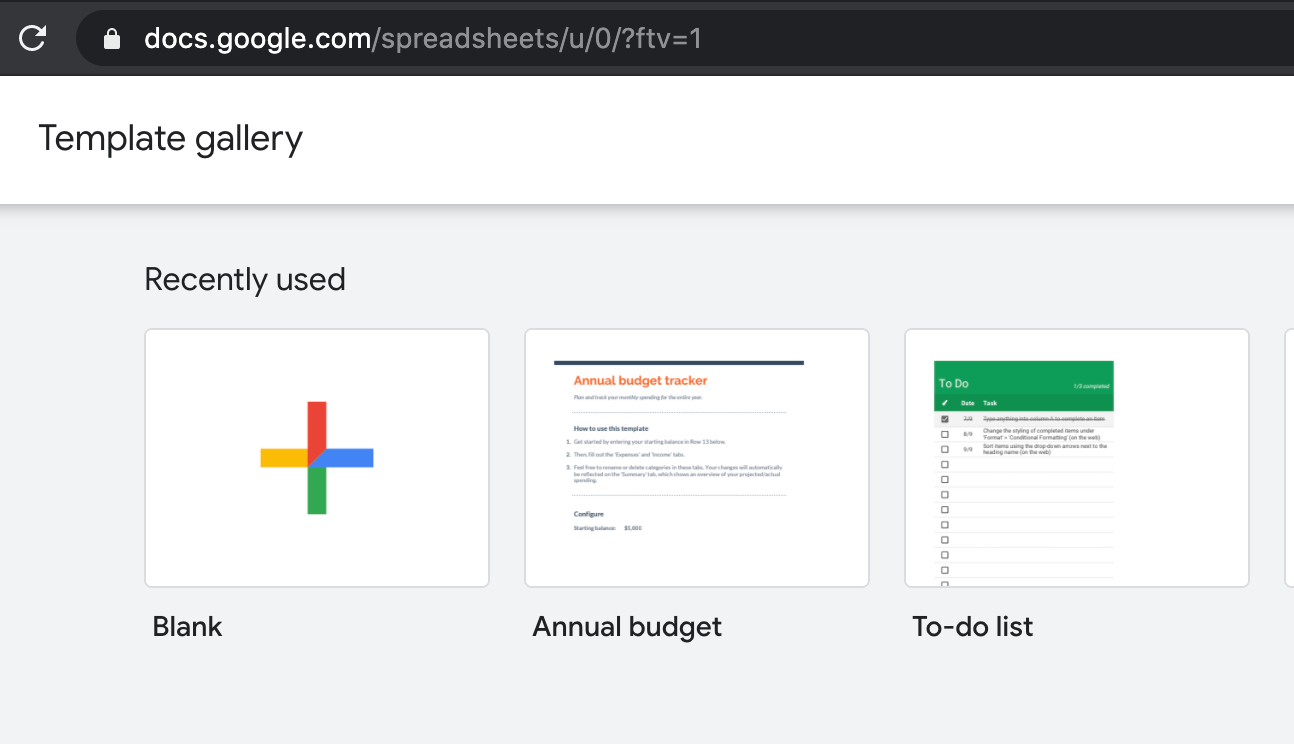

I did not show how to build the above calculations. You can do it on paper if you want, but it is much easier to use a spread sheet to build your budget. There are many examples available free online, so this should be an effortless process.

For example, when you create a new doc in Google Sheets, you can select the budget template. Just fill it the expenses and income sheets and your budget will pop out on the summary tab.

What Next?

Now it is time to put the plan into action. Follow these steps to build a budget and discover how much you can invest each month:

- Track your expenses for a few months to help predict future spending

- Identify any periodic or yearly expenses you might face this year

- Estimate your expected earnings this year

- Fill out an online budget template, for example, in Google Sheets

- Identify shortfalls and reduce expenses or plan borrowing to cover the months. If you choose borrowing, try to avoid credit card spending and factor in repayments in subsequent months.

- Figure out if you have a surplus at the end of the year.

- Divide the surplus by 12 and apply to each month. Will it cause a shortfall? If so reduce until it does not.

- Save this amount monthly by transferring to a separate savings account, so that you have at least three months expenses covered.

- Begin to invest when you have enough saved to cover emergencies

If you have no surplus, perhaps it is too soon to think about investing. What expenses to you have at present? Are there any you can reduce?

Often loans, such as credit card debt and car repayments are the cause of the expenses, but you cannot simply reduce these. Can you pay off the debt with the highest interest rate sooner? This may allow more leeway in future months.

Even if the saving outlook is not good, keep at it. The fact that you have gone as far as creating a budget means you are one step closer to improving your financial health.

If you have a surplus, well done. Join me in future posts as I investigate some options for investment.